The link between a great experience and spending patterns

From a commercial perspective, airports are in the enviable position of having a captive audience. But just because passengers are trapped in an airport doesn’t guarantee they will actually shop in it.

To truly reap the benefits airports need to provide the type of experience that puts passengers in the mood to shop. In short they need to focus on making passengers happy.

Most commercial experts agree that improvements in the overall experience tend to improve spend per individual. DKMA research confirms this assertion.

An airport’s most satisfied passengers:

- Are twice as likely to shop

- Spend 7% more on retail and 10% more on Duty Free

While it seems logical that passengers who are happy with the commercial experience are more likely to purchase, our data further suggests that satisfaction with the global airport experience also influences their likelihood to buy.

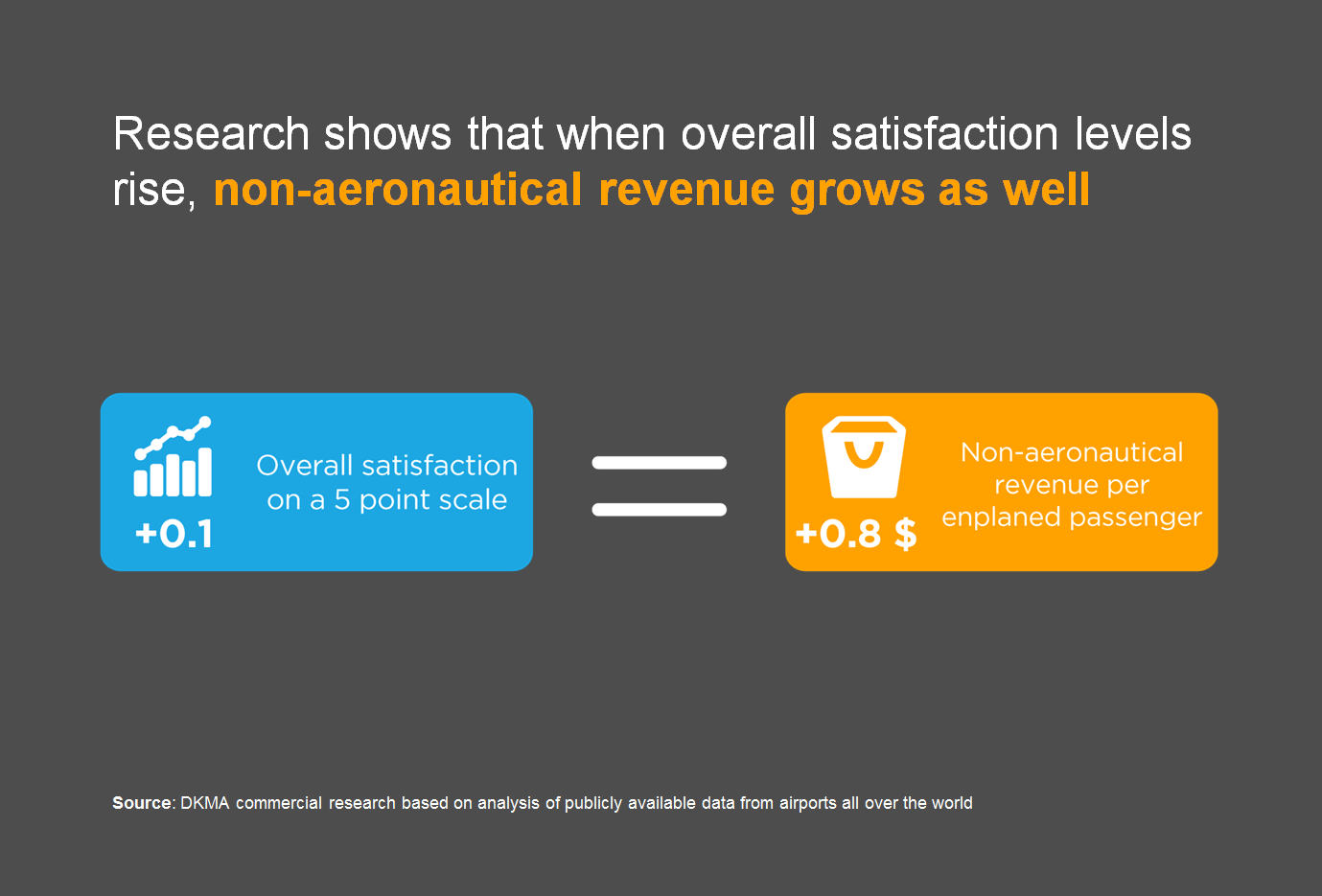

Analysis of publicly available data from airports around the world indicates that on average, an improvement in global satisfaction with the airport of 0.1 (on a 5 point scale) leads to an increase in non-aeronautical revenue per enplaned passenger of 0.8 USD.

Therefore improving the passenger experience should be a strategic goal for all airports seeking to grow commercial revenue. Unfortunately most airport commercial data focuses on spending patterns and fails to link these with satisfaction levels leaving airport managers without the insight they need to achieve this.

DKMA’s Airport Consumer Survey is designed to help airports bridge this gap by investigating the link between passenger satisfaction and how this influences their purchasing habits. Denver, Dubai, Kuala Lumpur, Mauritius, Montreal-Trudeau, Oslo, Tampa and nine other airports from Europe, Asia and North America took part in the survey in 2014.

So what are the findings from the survey and how can airports use these to grow their non-aeronautical revenue? Here are 4 key areas airports need to address if they want to grow their commercial revenue.

1. Promote the airport as a shopping destination

One of the key insights of the survey is the importance of pre-planned purchases.

What’s more, passengers who come to the airport with the intention of buying are 3 times more likely to purchase F&B, 6 times more likely to purchase retail and 7 times more likely to purchase Duty Free. They also spend more as well: 16% more on F&B, 54% more on retail and 34% more on Duty Free.

With the exception of retail, the battle is clearly won before passengers even reach the airport. The problem airports face is that currently only a small proportion of passengers pre-plan their purchases.

To overcome this, airports must adopt a more commercially-focused mentality and promote themselves much more effectively as a shopping destination. This needs to start with first point of contact most passengers have with the airport: the website.

Currently, on most airport websites you have to actively hunt to find information on the restaurants and shops and this is usually limited to a list of brands and locations. Selling the airport as an enticing shopping destination needs to be far more involving.

2. Improve the choice available

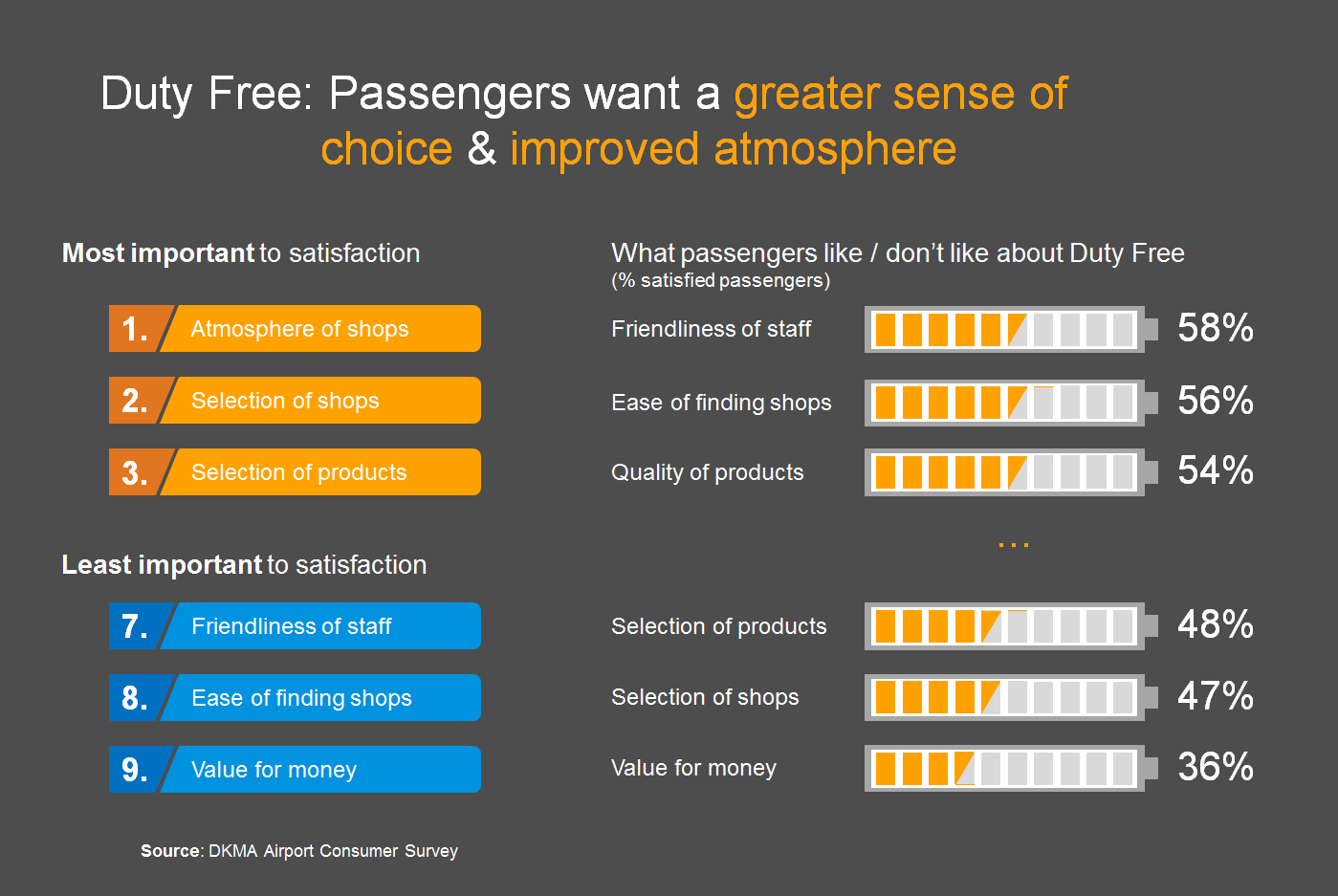

Another reason why passengers don’t currently view most airports as a shopping destination can be found in the analysis of satisfaction levels. While passengers are globally satisfied with the service they receive, they are unhappy with the choice of brands and products that airports offer.

The main problem here is that choice of shops / restaurants and choice of products are the key drivers of passenger satisfaction, whereas staff and service are less important to satisfaction. In other words, airports are not getting it right in the areas that matter most to passengers.

Airports are not shopping malls and there is always going to be a limit to the number of outlets or products they can offer. But to stand a chance of improving satisfaction levels airports need find ways to improve the perception of choice.

Ways of doing this include diversifying the mix of brands available to appeal to a larger portion of passengers and finding ways to provide a more unique commercial experience, instead of simply replicating what can be found at every other airport around the world.

3. Improve the perceived value of the retail offering

Even if passengers have pre-planned their purchase and are satisfied with the commercial experience, there are many factors that can prevent them from buying.

With a limited amount of time to spend in an airport, passengers have to make choices regarding how they spend their time; so if you want them to spend it shopping instead of sitting at the gate you have to provide true value.

Currently, F&B and Duty Free are doing a good job at this. Restaurants are one of the ways passengers like to kill time, explaining why 92% of passengers who planned to buy F&B end up doing do so. For Duty Free, the value proposition is attractive enough that passengers who want to shop will place it top of their priorities (84% who had planned to buy end up doing so).

For retail the situation is more complicated. Most products sold aren’t basic necessities and can easily be bought elsewhere. One statistic sums this up: more than 37% of passengers who came to the airport with the intention of buying retail go away empty handed.

Airports need to identify ways to create more perceived value in order to convince passengers that they should buy at the airport rather than simply waiting for the next possible occasion. Since most retail sales are impulse purchases, airports need to position shops so that they are seen by as many passengers as possible.

4. Get passengers to spend more time in the airport

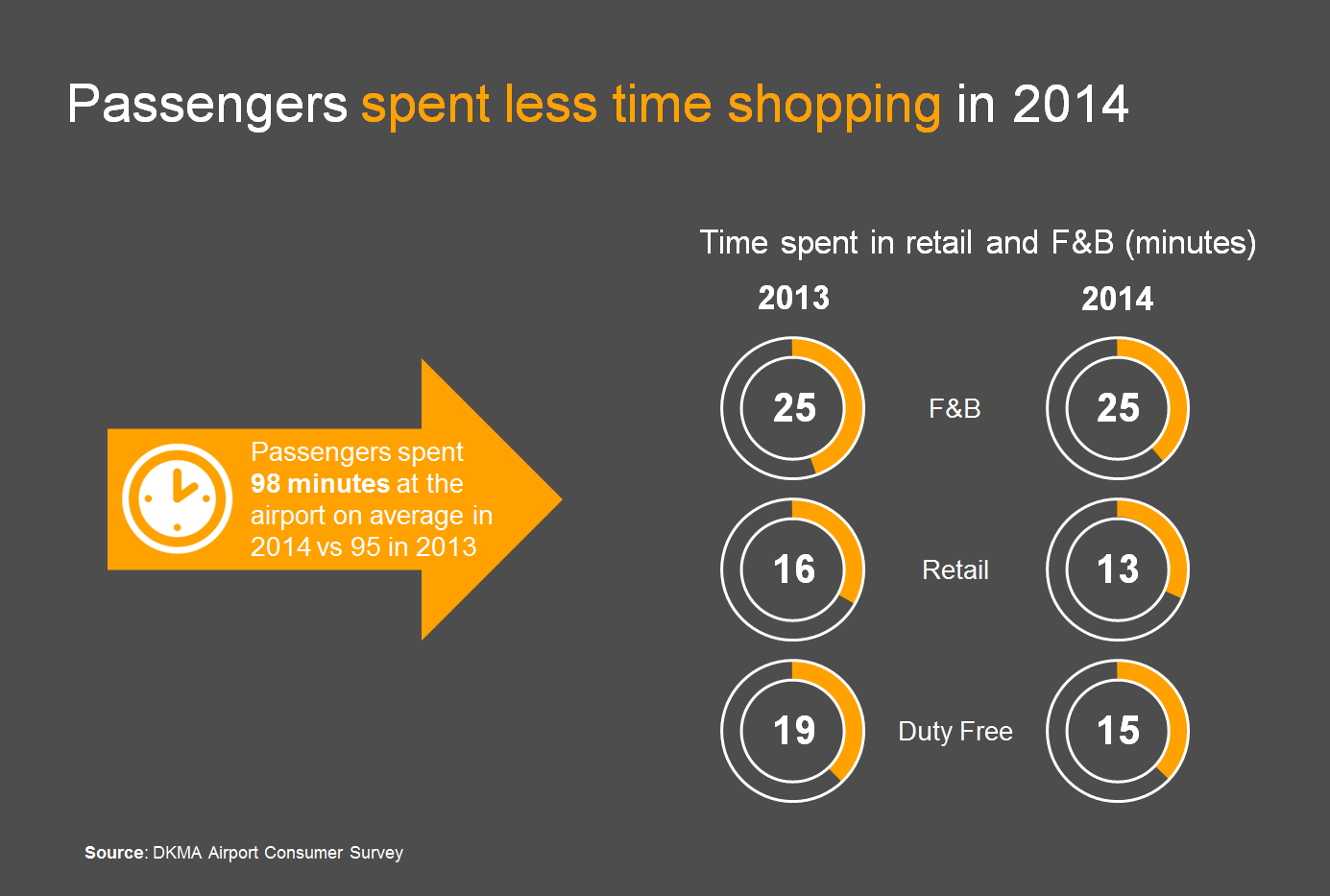

Although passengers spent slightly more time at the airport in 2014 (98 minutes on average), the amount of time they spent shopping dropped.

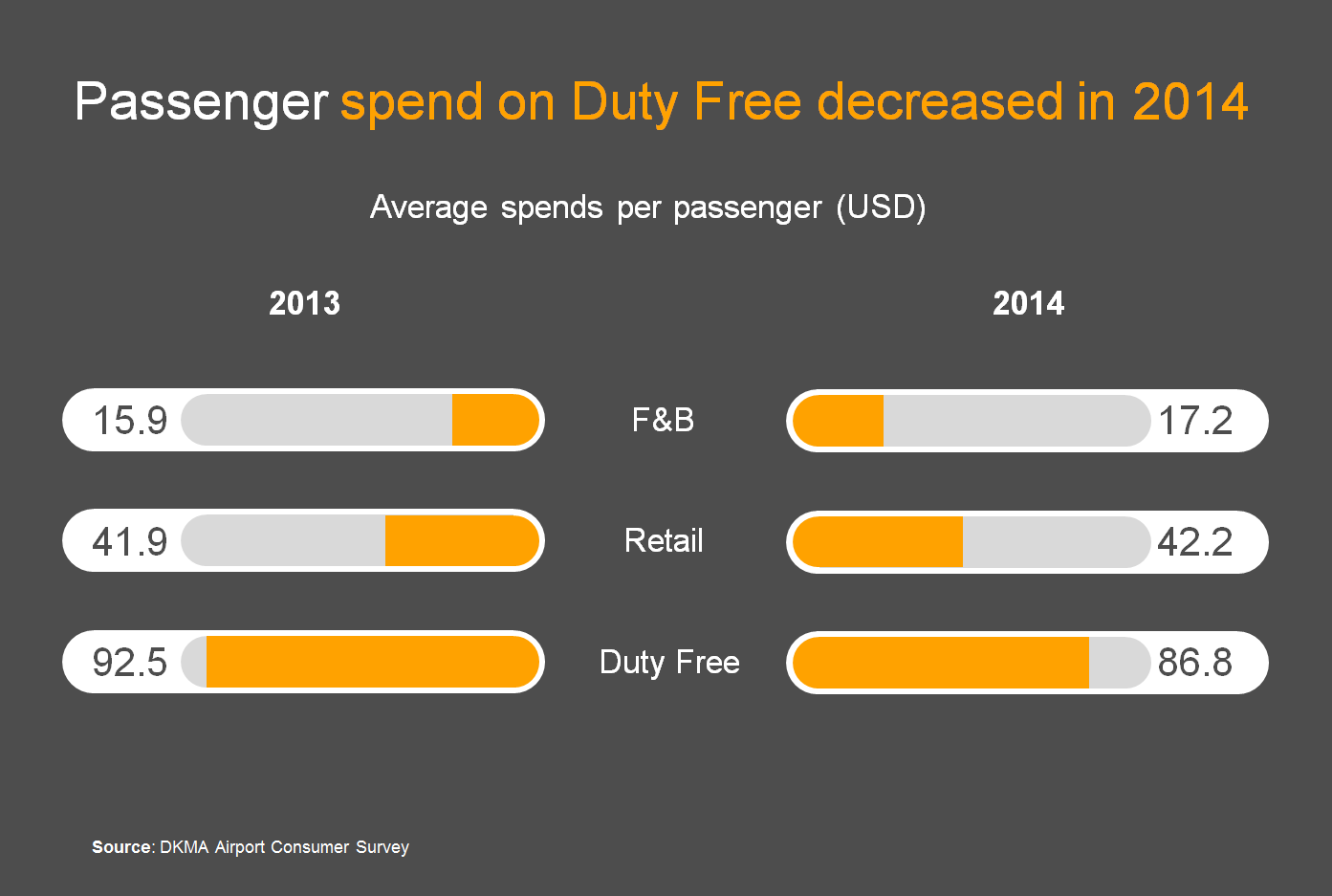

These might seem like small changes but they can have a direct impact on an airport’s bottom line. Indeed, although average spends on retail and F&B were similar or slightly higher, the average passenger spend on Duty Free dropped by a fair amount in 2014.

To address this, airports need to ensure that processes are not eating up too much of the time passengers have at the airport. They need to work on increasing dwell time as much as possible since passengers who spend more than 60 minutes at the airport are 34% more likely to buy F&B, 38% more likely to buy retail and 26% more likely to buy Duty Free than passengers who spend fewer than 60 minutes at the airport.

This brings us back to the need for improving satisfaction levels. Indeed, an airport’s most satisfied passengers spend 10% more time at the airport on average. Proof that when passengers are satisfied with an airport they are more likely to view it as part of their trip and change their travel habits to spend more time there.

Conclusion

Taken together, these four findings represent important levers airports have to increase commercial sales.

Our research also suggests that airports should not view growing non-aeronautical revenue as being simply a question of improving the shops and restaurants. The whole experience passengers have of the airport, from processes to wayfinding to washrooms influences their likelihood to purchase.

The airports which are most likely to successfully grow non-aeronautical revenue are those which have made customer service a key strategic priority.

Pingback: 12 Behind-the-Scenes Secrets of Airports

Pingback: 12 Behind-the-Scenes Secrets of Airports - News4Security